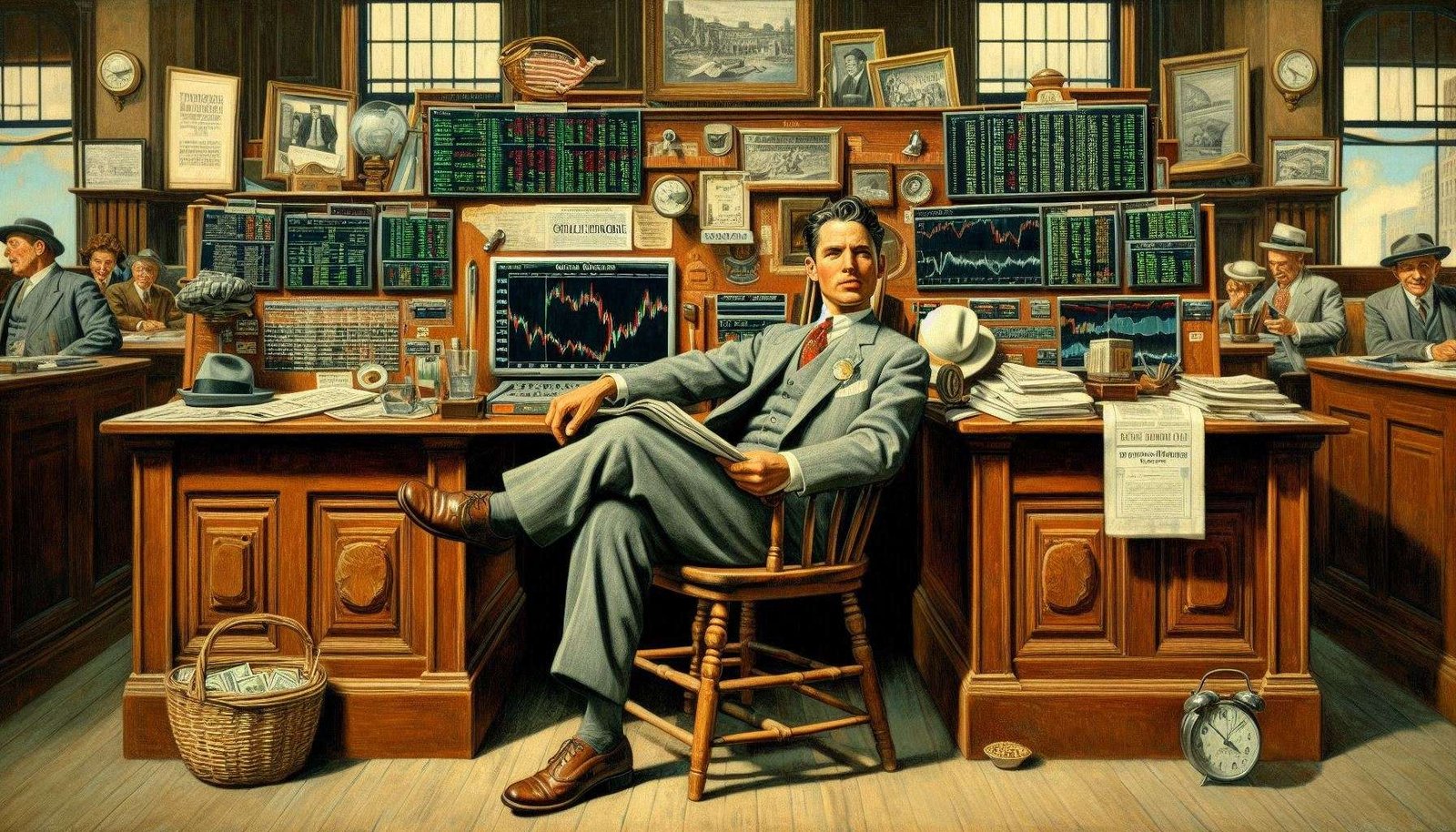

Here is very nice podcast about the book about the famous trader Jesse Livermore (1877-1940) was one of the most famous stock traders in American history, often referred to as the “Boy Plunger” or the “Great Bear of Wall Street. At his peak, Livermore was worth millions of dollars (equivalent to hundreds of millions in today’s money). He made and lost several fortunes throughout his career.

Early Career: Livermore began trading stocks at a very young age, starting with bucket shops (illegal gambling establishments that took bets on stock prices) in his teens.

Notable Achievements: He made several legendary trades, including:

Shorting the market before the Panic of 1907

Predicting and profiting from the stock market crash of 1929

Financial Success: At his peak, Livermore was worth millions of dollars (equivalent to hundreds of millions in today’s money). He made and lost several fortunes throughout his career.

Trading Philosophy: He was known for his discipline and pioneering use of technical analysis and market psychology. His trading strategies emphasized the importance of:

Cutting losses quickly

Letting profitable trades run

Understanding market trends

Personal Life: Despite his financial success, Livermore struggled with personal challenges, including multiple marriages and severe depression.

Legacy: His life and trading experiences were chronicled in the famous book “Reminiscences of a Stock Operator” by Edwin Lefèvre, which is still considered a classic among traders and investors.

Tragically, Livermore died by suicide in 1940, having lost most of his fortune.

His life story remains a cautionary tale about the psychological challenges of trading and the importance of emotional discipline in financial markets

Here is the link to the book on Amazon: Click Here

New!

Eightcap Trade CFDs on FX, Cryptos, Indices and more with a leading global broker. Start trading on low spreads today and choose from over 800 financial instruments.

Featured

Trading View They have wonderful technical analysis indicators and charts and can be used with many different brokerage companies. Many of the videos i post about trading strategies use the technical indicators on TradingView.

Back Testing, Brokers, Charting Platforms and Copy Trading

eToro is one of the world’s leading social investment communities that allows people to grow their knowledge and they offer 0% commissions and the ability to by buy fractional shares and invest exactly how much you want. They also offer a free demo account. Not available in all countries.

HYCM offers a straightforward MetaTrader platform experience and a proprietary mobile app. Its Raw account delivers competitive pricing.

LuxAlgo the #1 provider of trading indicators worldwide. Trusted by over 50,000+ traders.

MetaStock has been providing award-winning charting and analysis tools for the self-directed trader for over 30 years. Capitalizing on technical analysis, our line of trading software and market data are designed for active traders of all levels so they can backtest, scan and analyze the markets with confidence Free Trial Free Book Buy One get One Free

SignalStack Turns your alerts into executed orders without any coding and can connect with your brokerage account including TradingView and many others.

TraderEdge Backtest & Journal all Your Trades. Backtesting your indicators and strategies has never been easier. Get up to 3X faster results than using spreadsheets.

Trade Ideas Visit the Trade Ideas Professional services site and request a Demo or more information. Trade Ideas provides Trading Education, Practice, and Support to successful investors.

Trading View They have wonderful technical analysis indicators and charts and can be used with many different brokerage companies. Many of the videos i post about trading strategies use the technical indicators on TradingView.

ZuluTrade Join the most transparent social trading network! Copy Top Performing Traders from different Brokers easily and reach your investment goals!