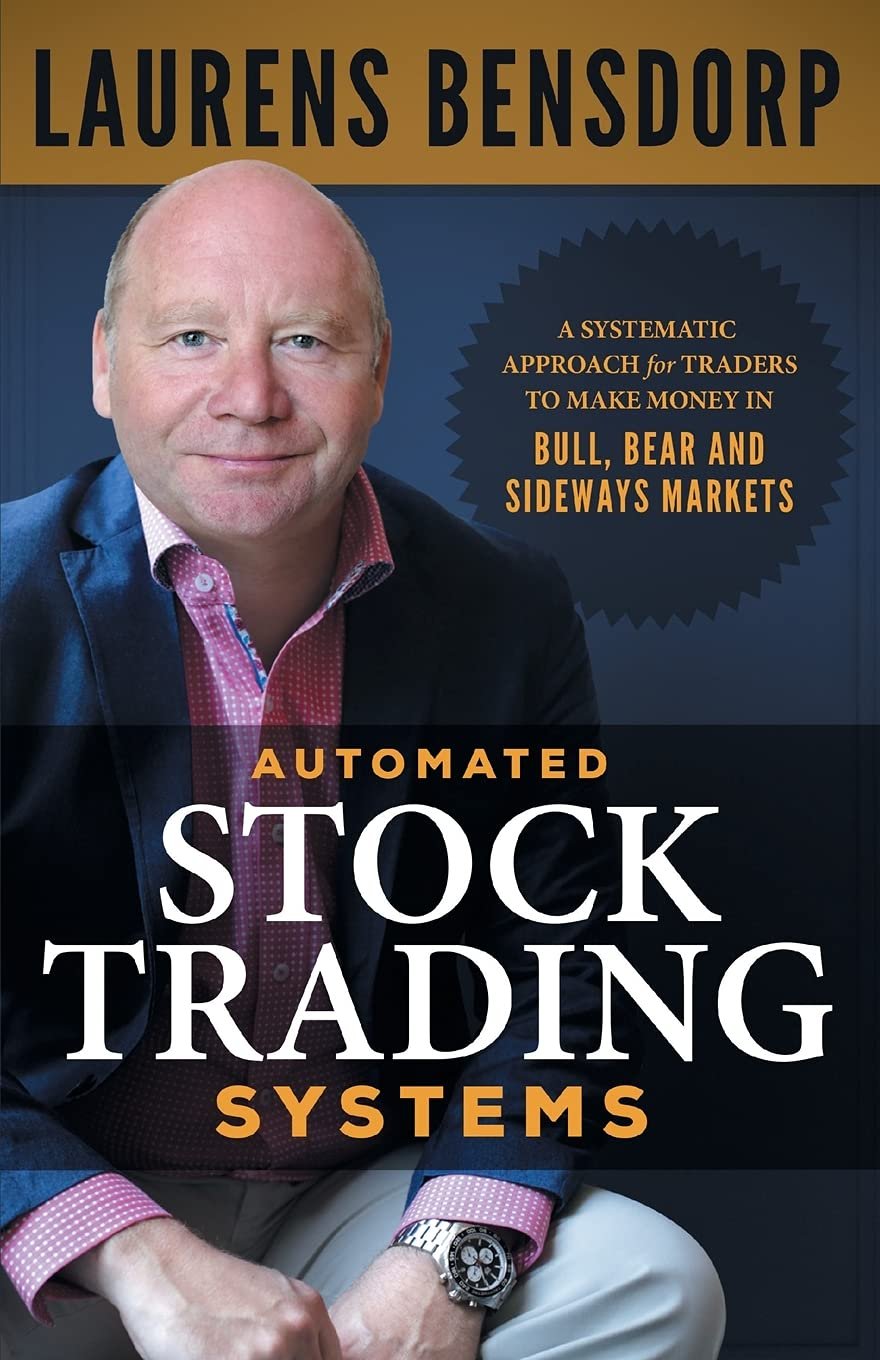

When it comes to trading stocks, consistency and profitability are the Holy Grail that many seek. For those trying to navigate the often-turbulent waters of the stock market, Laurens Bensdorp’s Automated Stock Trading Systems offers a beacon of hope. This book serves not only as a guide but as a blueprint for traders looking to grow their investments with reduced risk, regardless of market conditions. Today, we’re diving into this fascinating book that claims to make trading accessible for everyone, whether the market is soaring or stuck in a rut.

Key Features

Bensdorp’s book isn’t just another run-of-the-mill trading manual; it presents a systematic approach that combines multiple quantitative trading systems tailored to different market conditions—bull, bear, or sideways. Let’s break down the key features that make this book stand out:

-

Comprehensive Multi-System Approach: The heart of Automated Stock Trading Systems lies in its non-correlated, multi-system strategy. This allows traders to create a personalized trading framework that adapts to changing market conditions, maximizing potential returns while minimizing risk.

-

Time-Tested Strategies: Backed by 24 years of historical data and simulations, the methods outlined promise consistent, high double-digit returns with low drawdowns. This means you won’t just be crossing your fingers; you’ll have data backing your trades as you go.

-

Clear, User-Friendly Language: One of the standout praises from readers is the book’s accessibility. Bensdorp lays out complex ideas in simple terms, making it a breeze even for traders who might not have extensive experience.

-

Emphasis on Risk Management: A crucial element for any trader, the book teaches risk management strategies that enhance risk-adjusted returns. After all, it’s not just about making money; it’s about protecting what you’ve already earned.

Pros & Cons

As with any product, there are both strengths and weaknesses to consider when it comes to Automated Stock Trading Systems.

Unlock Your Trading Potential Today!

Pros:

- Well-Explained Strategies: Most readers agree that the strategies are clearly laid out and easy to follow, making it appealing for both novice and experienced traders.

- Value for Money: Many customers are delighted with the book’s content relative to its price, deeming it an excellent investment for anyone looking to tidy up their trading game.

- Time-Saving: The straightforward approach not only allows for faster learning but also speeds up the trading process itself.

Cons:

- Limited for Advanced Traders: A few reviews noted that while the book is great for beginners, seasoned traders might find it lacks the in-depth complexity they seek.

- Simulations vs. Real-Life: While the book showcases impressive backtested results, it’s wise to approach these with caution, as real market conditions can fluctuate wildly.

Who Is It For?

Automated Stock Trading Systems is tailor-made for a variety of audiences. It’s ideal for:

Explore Automated Trading Systems Now!

- New Traders: Those just getting their feet wet in stock trading will find Bensdorp’s guidance invaluable, with easy-to-understand concepts and practical strategies.

- Intermediate Traders: Even those with some experience under their belts can benefit significantly from the book’s systematic approach and risk management strategies.

- Diligent Investors: If you appreciate a methodical, data-driven approach to trading and are looking for a way to enhance your investment prowess without drowning in complex jargon, this book is definitely for you.

Final Thoughts

In the unpredictable theater of stock trading, Automated Stock Trading Systems stands out as a reliable ally. The book’s significant focus on systematic, risk-adjusted growth paired with its straightforward language makes it a go-to resource for both novice and slightly seasoned traders. While it might not cater to every advanced trader’s appetite for complexity, it excels in offering a structured pathway to consistent profitability.

Learn How to Profit in Any Market!

So, whether you’re battling the bears, riding the bulls, or trying not to get seasick in sideways markets, Laurens Bensdorp’s insights could very well enhance your journey in the world of trading. After all, who wouldn’t want to find a little more profitability and a little less risk in their investment endeavors?

As an Amazon Associate, I earn from qualifying purchases.

If you are looking for more information on technical analysis, trading advisories, brokers. trading platforms, trading systems, copy trading and more please visit our resources page: