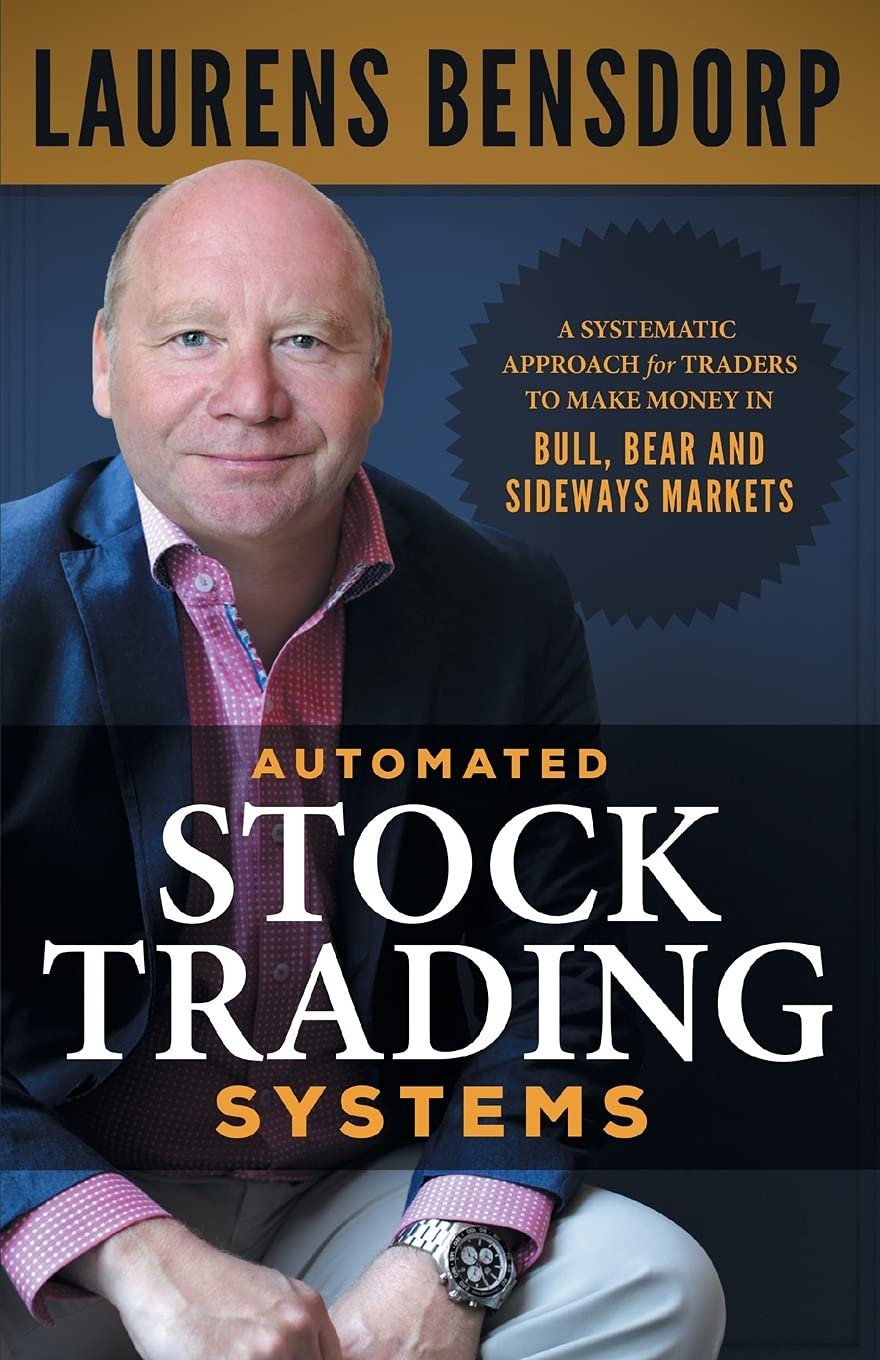

If you’ve ever thought the stock market is a bit like trying to juggle flaming torches while riding a unicycle – well, you’re not far off. Now, imagine if there was a way to take some of the unpredictability out of all that, something systematic, reliable, and automated. That’s where Automated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and Sideways Markets by Laurens Bensdorp steps in. This book aims to be the trading equivalent of a steady hand holding the reins amid the wild rides of market swings.

Key Features

First off, what makes this approach stand out? Bensdorp has combined multiple quantitative trading systems, each designed to excel in different market conditions — bull markets, bear markets, and even sideways ones that can leave traders scratching their heads. By blending these, the system seeks to minimize risk and maximize returns regardless of the market’s mood.

Bensdorp’s method leans heavily on historical price action to carve out statistical edges. Think of it like reading the market’s diary, to spot patterns without guessing wildly. The beauty here is in automation: once the system is built, it runs with minimal emotional interference – a known nemesis for traders everywhere. The book details how to build and tailor these systems yourself, so it’s not just theory but practical application.

Unlock the Secrets of Automated Trading!

One of the Jolly Good Features is its emphasis on risk management. The combined systems reportedly deliver consistent high double-digit returns with low drawdowns over a 24-year test period – somewhat like having an umbrella that keeps you dry in sun, rain, or snow.

Transform Your Trading Strategy Today!

Pros & Cons

Looking at the vast chorus of customer voices – 287 reviews with an average of 4.4 stars – there’s considerable praise for how clear and well-explained the strategies are. Readers say it’s easy to follow, even if you’re not a Wall Street wiz, and appreciate that it’s a real time-saver. One handy compliment noted that this book “lays out exactly how systems are used,” making it less of a cryptic code and more of a transparent roadmap.

Customers also point out its value for money – at just under $14, it’s a modest investment for potentially serious insight. Plus, the risk management angle seems to resonate well, with users highlighting how the approach enhances risk-adjusted returns.

On the flip side, some readers might find the systematic trading jargon a touch dense if they’re complete beginners. The book assumes some familiarity with trading concepts, so casual investors might need to brush up elsewhere first. Additionally, as with all automated systems, there’s the caveat that no approach is foolproof, and historical success doesn’t guarantee future results.

Who Is It For?

If you’re a trader who’s tired of riding emotional roller coasters or guessing which way the market winds will blow, this book is likely a good fit. It’s perfect for those with some foundational knowledge seeking to understand how to build and automate market strategies that adapt to any market condition. Also, anyone interested in reducing risk without sacrificing returns will find the systematic methods in this book appealing. For the hands-on investor willing to dig into the numbers and algorithms, this could be the steadying course you’ve been after.

Maximize Your Profits with Our Systematic Approach!

Final Thoughts

Automated Stock Trading Systems offers a thoughtfully crafted, practical guide for traders looking to tame the wild beast of market variability through systematic, automated strategies. It’s not a get-rich-quick manual, but rather a methodical approach blending history, statistics, and automation to aim for consistent, reliable returns. While it may demand some initial learning, its clear explanations and risk-conscious design make it a valuable tool in the trader’s toolkit.

So, if you’re looking to move beyond gut feelings and into a more measured, data-backed trading game plan, Laurens Bensdorp’s approach might just be the way to light the path through those market fluctuations. After all, as Dick Louden might say, “It’s not about predicting when it’ll rain; it’s about having a sturdy umbrella ready.” And this book gives you the umbrella.

As an Amazon Associate, I earn from qualifying purchases.

If you are looking for more information on technical analysis, trading advisories, brokers. trading platforms, trading systems, copy trading and more please visit our resources page: