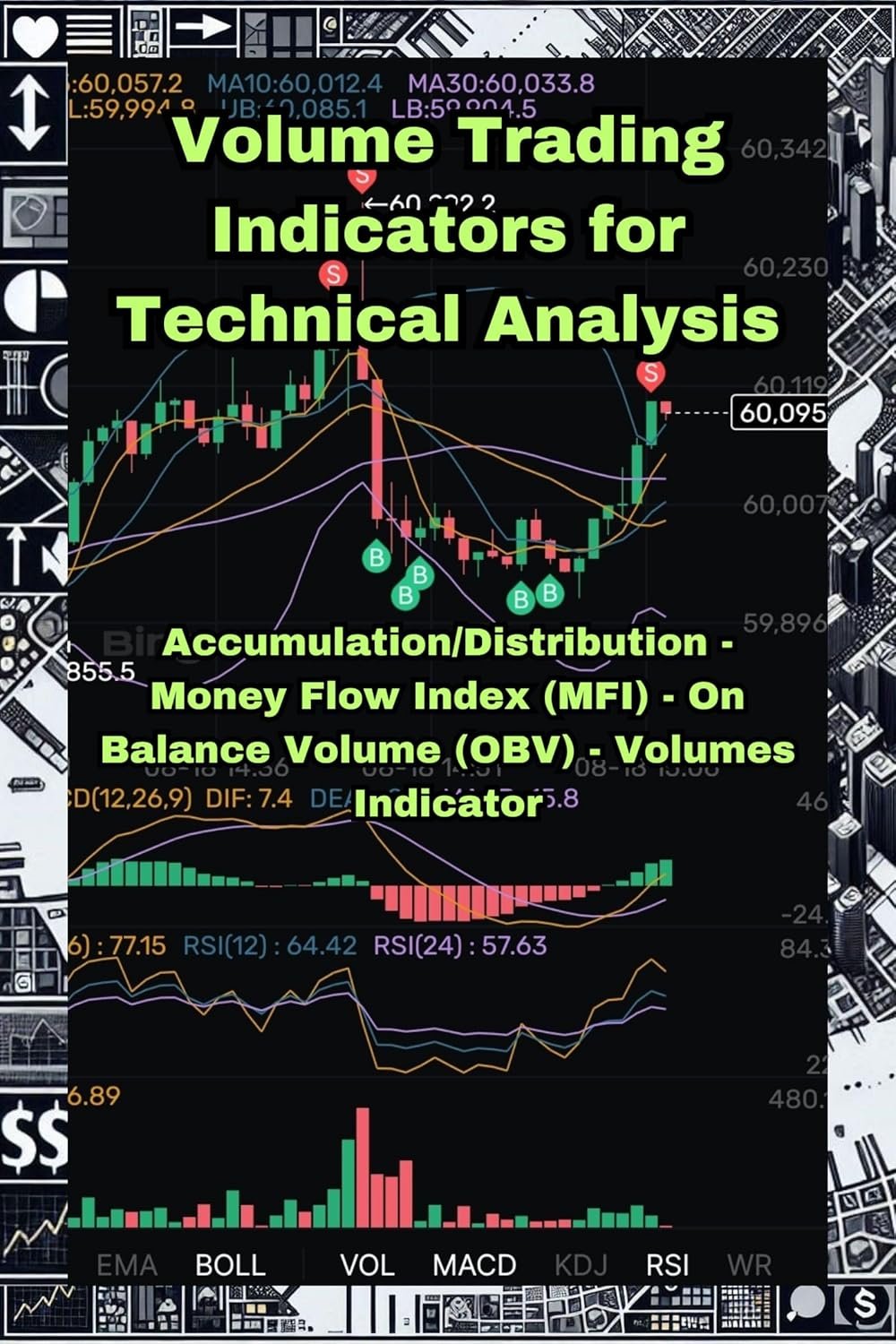

In the fast-paced world of trading, understanding volume data is crucial for making informed decisions. If you’ve been looking for a guide to help you navigate this complex landscape, look no further than the Volume Trading Indicators for Technical Analysis. This comprehensive resource offers an in-depth exploration of key volume-related oscillators that can elevate your trading game.

Key Features

The Volume Trading Indicators for Technical Analysis discusses four essential volume indicators: Accumulation/Distribution, Money Flow Index, On Balance Volume (OBV), and the broader Volumes Indicator. Let’s take a closer look at what each of these features brings to the table and how they can benefit you:

-

Accumulation/Distribution: This indicator helps traders understand whether a stock is being accumulated (bought) or distributed (sold). By analyzing price and volume together, you can better determine future price movements.

-

Money Flow Index: Often called the ‘relative strength index for volume,’ the Money Flow Index indicates overbought or oversold conditions by evaluating both price and volume. It’s a handy tool for assessing market conditions and determining entry and exit points.

-

On Balance Volume (OBV): A classic in the technical analysis toolkit, OBV measures cumulative volume flow to predict changes in share price. It’s particularly effective in identifying trends, making it a must-have for every serious trader.

-

Volumes Indicator: This feature encompasses both volume and momentum indicators, providing a holistic view of market activity. Understanding volume in the context of price movements can reveal hidden trends, offering traders an opportunity to gain a strategic edge.

Each of these indicators allows traders to interpret market behavior more accurately, ultimately helping to enhance their trading strategies.

Discover Advanced Trading Tools

Pros & Cons

While the Volume Trading Indicators for Technical Analysis presents valuable insights, it’s essential to consider both the positives and negatives:

Pros:

- Comprehensive Knowledge: The guide covers crucial volume indicators, offering in-depth explanations and applications. Perfect for traders looking to expand their toolkit.

- User-Friendly: Written in an approachable style, even beginners can grasp complex concepts easily.

- No Cost: The best part? You can access this invaluable resource for free, making it an ideal addition to any trader’s library.

Cons:

- Lack of Reviews: As it currently stands with zero reviews, potential buyers might hesitate since there’s no feedback to assess the quality or effectiveness of the guide.

- No Visual Aids: While the text is informative, some might prefer additional visuals or charts to support the concepts discussed.

Who Is It For?

The Volume Trading Indicators for Technical Analysis is tailored for both novice and experienced traders looking to refine their volume-based trading strategies. If you are someone who wants to understand the pulse of the market better or are looking to integrate volume analysis into your trading routine, this guide is right for you. Whether you’re day trading, swing trading, or investing for the longer term, understanding these indicators can give you an edge.

Enhance Your Analysis with Volume Indicators

Final Thoughts

In conclusion, the Volume Trading Indicators for Technical Analysis provides an excellent foundation for anyone looking to harness the power of volume in trading. With a focus on four vital indicators, this guide can empower traders to make more informed decisions and improve their analytical skills. While it’s still new and hasn’t accumulated reviews, the qualities of the guide—its depth of information, user-friendliness, and zero cost—make it a worthwhile addition to your trading arsenal. So dive in, explore these indicators, and let them guide you toward more successful trades.

As an Amazon Associate, I earn from qualifying purchases.

If you are looking for more information on technical analysis, trading advisories, brokers. trading platforms, trading systems, copy trading and more please visit our resources page: