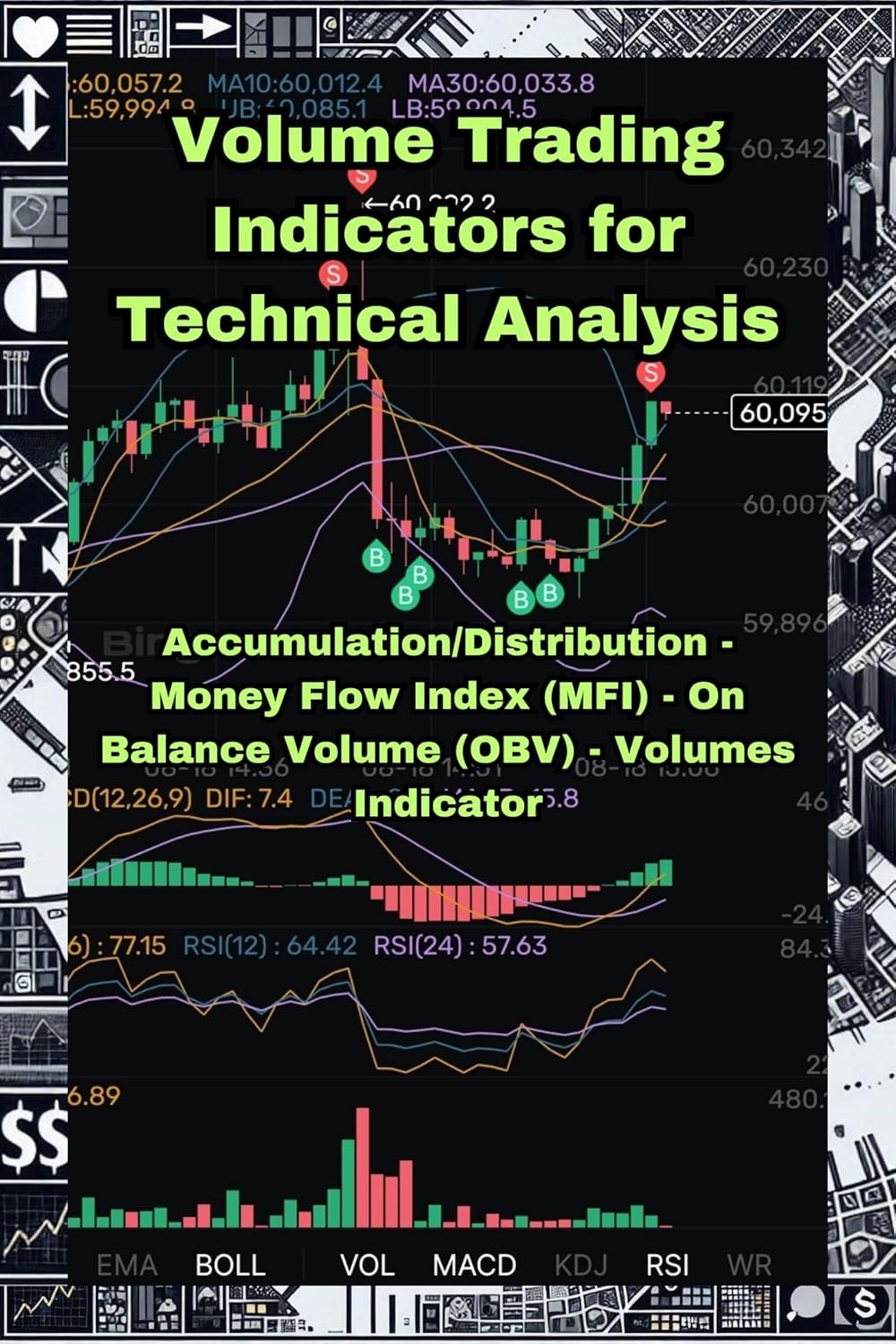

When it comes to trading in the stock market, understanding volume is key. Just like a bustling café is a good sign of fresh brewed coffee, high trading volume can indicate a strong interest in a stock. That’s where the Volume Trading Indicators for Technical Analysis comes into play. This comprehensive guide dives into the basics of volume-based trading, making it a must-have for both seasoned traders and newcomers alike. So, let’s take a closer look at what this guide offers and why it’s worth your time.

Key Features

This guide showcases four vital volume-related indicators that are essential in technical analysis:

-

Accumulation/Distribution: This indicator helps in understanding whether a stock is being accumulated (bought) or distributed (sold). It provides valuable insight into the supply and demand of a security, as it tracks price trends relative to volume. If a stock is showing signs of accumulation, it could be a great time to consider purchasing.

-

Money Flow Index (MFI): The MFI is a momentum indicator that shows the buying and selling pressure. It ranges from 0 to 100 and can help identify potential overbought or oversold conditions. If you’re trying to find the perfect timing for entering or exiting a position, the MFI can be your guiding light.

-

On-Balance Volume (OBV): This one is straightforward yet powerful. The OBV aggregates volume based on price movement, offering clear signals about the direction of a stock’s trend. If you’re keen on seeing whether the volume supports the price movement, this indicator is a reliable ally.

-

Volumes Indicator: While this term is broad, in the context of this guide, it covers additional volume and momentum indicators that help paint a complete picture of market sentiment and price action. Understanding these can help you better strategize your trades.

Together, these indicators can help you make informed decisions, potentially improving your trading outcomes.

Pros & Cons

Like a good cup of coffee, this guide isn’t without its strengths or weaknesses. Let’s take a look:

Unlock the Secrets of Volume Trading!

Pros:

- Comprehensive Analysis: The guide delves deeply into each indicator, providing traders with a rich understanding of how to apply them.

- User-Friendly: With a straightforward layout and easy-to-follow explanations, even those new to trading can grasp the concepts.

- Practical Applications: The indicators highlighted in the guide can be used in real-world trading scenarios, making it a practical tool.

Cons:

- Limited Feedback: With zero reviews currently, prospective users may hesitate, as they can’t draw from the experiences of others.

- No Visuals: Depending on the format, a lack of charts or examples could leave some readers wanting more visual guidance to apply the concepts effectively.

Who Is It For?

The Volume Trading Indicators for Technical Analysis is ideal for anyone looking to enhance their trading prowess, particularly those who prefer a data-driven approach. Whether you’re a rookie just starting to dip your toes in the trading waters or a veteran looking for strategies to refine your existing trades, this guide can provide the insights you need.

Discover Powerful Trade Indicators Now!

Final Thoughts

In conclusion, the Volume Trading Indicators for Technical Analysis is a solid resource that aims to unlock the potential of volume-based trading. With its focus on key indicators like Accumulation/Distribution and the Money Flow Index, it equips users with tools to interpret market signals effectively. While it currently lacks user reviews to bolster its credibility, the content promises depth and practicality. If you’re serious about making your trading game stronger, this guide might just be the gentle nudge you need to delve into the intricate world of volume analysis. So why not give it a look? After all, understanding the market is akin to knowing the secret recipe of your favorite dish—once you have it, the possibilities are endless!

Boost Your Trading Success—Learn More!

As an Amazon Associate, I earn from qualifying purchases.

If you are looking for more information on technical analysis, trading advisories, brokers. trading platforms, trading systems, copy trading and more please visit our resources page: