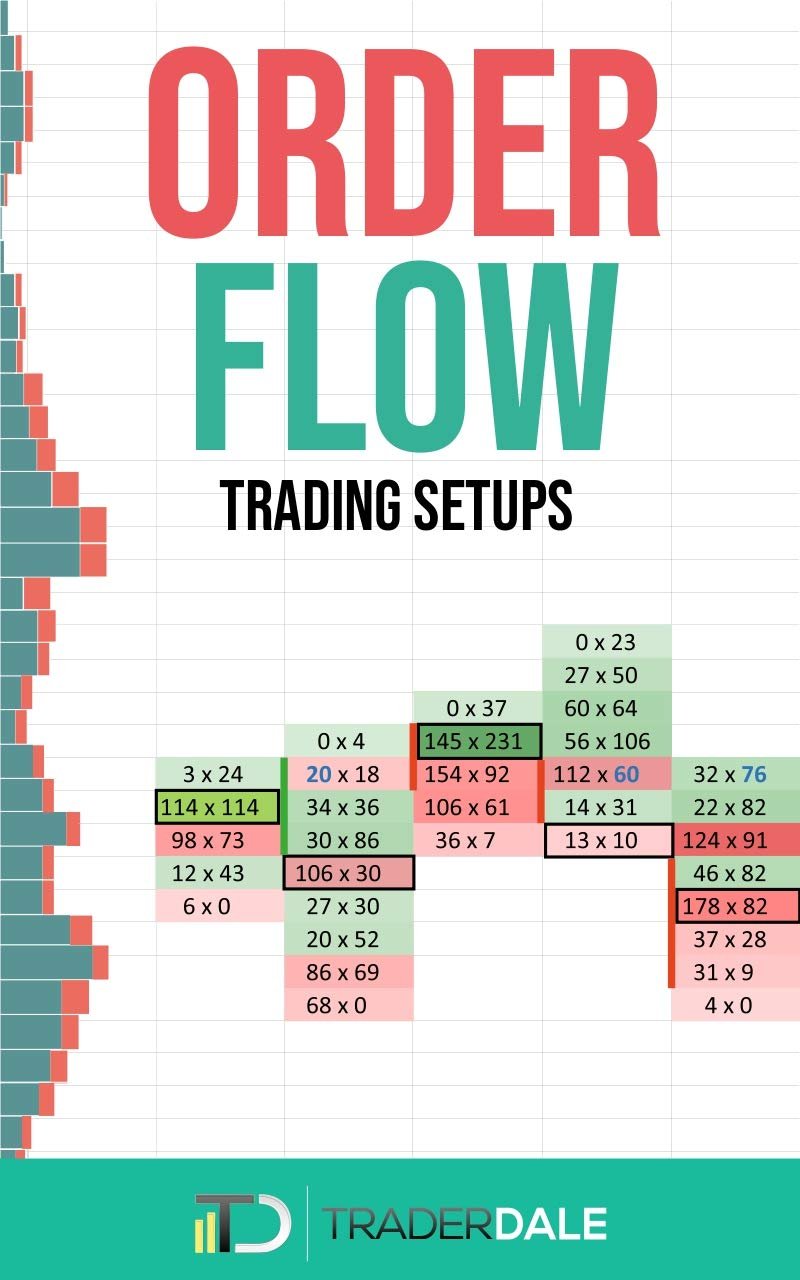

Ah, trading! The thrilling dance of numbers, graphs, and sometimes, just pure luck. If you’ve ever wanted to wade into the world of financial markets but didn’t know where to dip your toes, you might just find a friend in the pages of ORDER FLOW: Trading Setups (The Insider’s Guide To Trading). Authored by Dale, a seasoned trader with 15 years of firsthand experience, this guide offers valuable insight for anyone looking to understand the undercurrents of market movements.

Key Features

This trading guide is built on some nifty tools that help you get into the minds of big-time traders. Here’s an overview of its primary features:

-

Volume Profile, Order Flow, and VWAP: If these terms sound like they belong in a math book, fear not. Dale breaks them down so that even the most un-mathematically inclined among us can understand their importance. These indicators show where trades are happening and, ultimately, where the price might go next. Knowing what the big players are doing can enhance your trading decisions significantly.

-

Detailed Insights: The book provides snapshots of real trades, detailing moments when a large order was placed. For example, if a significant buy limit order emerges, it could indicate a possible price reversal. This transparency into the market can be very empowering for intraday trading.

-

Expertise Sharing: Not only does Dale share his trading strategies, but he’s also dedicated himself to helping aspiring traders improve through tailored indicators. The simple layout makes it easy to follow along, even for those starting fresh in trading.

Pros & Cons

Like any product, ORDER FLOW has its strengths and areas that might need a little fine-tuning. Let’s break it down:

Unlock Insider Trading Secrets

Pros:

-

Accessibility: Many reviewers appreciate the straightforward writing style. Even complex trading concepts are unpacked with clarity, making it easy for novices to grasp.

-

Community and Guidance: Dale’s passion for sharing knowledge shines through. His website offers a supportive environment where traders can learn together, enhancing the value of the book.

-

Relevance: The focus on volume-based trading keeps this book relevant in today’s fast-paced market environment.

Cons:

-

Depth of Content: On the flip side, several reviews mention that while it’s easy to digest, some readers were hoping for deeper analytics. They feel that the book sometimes skims the surface instead of diving deep into the nitty-gritty of trading strategies.

-

Specialized Audience: As a guide for intraday trading, those interested in swing trading or long-term investing might find some of the strategies less applicable.

Who Is It For?

ORDER FLOW is ideally suited for newer traders who want to familiarize themselves with the dynamics of market motion. If you’re intrigued by the idea of trading alongside major institutions—or simply looking to build a foundational understanding of volume-based trading—this book will serve you well. It’s also an excellent companion for any traders who appreciate clear, concise direction without being overwhelmed by technical lingo.

Final Thoughts

In closing, ORDER FLOW: Trading Setups (The Insider’s Guide To Trading) presents a friendly entry point into the world of trading. While it may not cater to every seasoned trader’s appetite for in-depth analysis, it offers a treasure trove of practical insights for beginners. The simplicity and accessibility make it a worthy addition to any aspiring trader’s bookshelf. If you’re keen on demystifying the market and learning to trade with the big leagues, this guide might just hold the key to unlocking your trading success.

With a solid rating of 4.2 out of 5 stars and hundreds of reviews, it seems many have already found their footing in the vast sea of trading. Happy trading!

As an Amazon Associate, I earn from qualifying purchases.

If you are looking for more information on technical analysis, trading advisories, brokers. trading platforms, trading systems, copy trading and more please visit our resources page: